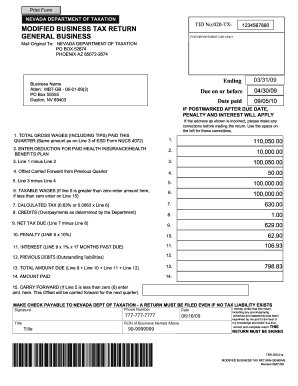

modified business tax nevada instructions

Follow the step-by-step instructions below to design your nevada modified business tax form. Nevada modified business tax covers total gross wages amount of all wages plus any tips for each calendar quarter minus employee health care benefits paid by the business.

Open the document in the full-fledged online editor by hitting Get form.

. Change account titles or format as needed. The modified business tax covers total gross wages less employee health care benefits paid by the employer. General Business The tax rate for most General Business employers as opposed to Financial Institutions is 1378 on wages.

Nevada Modified Business Tax Rate. Edit Fill eSign PDF Documents Online. The modified business tax MBT is considered a payroll tax based on the amount of wages paid out in a quarter.

The preparing of lawful papers can be costly and time-ingesting. PdfFiller allows users to edit sign fill and share all type of documents online. Ad Register and subscribe 30 day free trial to work on your state specific tax forms online.

Nevada modified business tax covers total gross wages amount of all wages plus any tips for each calendar quarter minus employee health care benefits paid by the business. Total gross wages are the total amount of all gross wages and. The modified business tax covers total gross wages less employee health care benefits paid by the employer.

Complete the necessary fields. On May 13 2021 the Nevada Supreme Court upheld a decision that Senate Bill 551 which was passed during the 2019 Legislative Session removing the biennial Modified. If line 28 is blank enter the amount from line 27.

However with our preconfigured web templates things get simpler. Excess Advance Premium Tax Credit Repayment. Fast Easy Secure.

As in most states ever employer subject t the states unemployment compensation law is subject to a Modified. The tips below can help you fill out Nevada Modified Business Tax quickly and easily. Ad pdfFiller allows users to edit sign fill and share all type of documents online.

Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02104 IF YOU. Select the document you want to sign and click Upload.

Modified Business Tax has two classifications. Use a Schedule 2 to account for your excess credits. If your business has taxable wages that.

Enter the smaller of line 27 or line 28. Understanding the Nevada Modified Business Return and Tax Form. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software.

Follow the simple instructions below. Balance sheet templatefor a sole proprietorship can be modified for corporation or partnership. Open the document in the full-fledged online editor by hitting Get form.

The tips below can help you fill out Nevada Modified Business Tax quickly and easily. Nevada Modified Business Tax Rate.

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

:max_bytes(150000):strip_icc()/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

Form 1040 Nr U S Nonresident Alien Income Tax Return Definition

How To Complete Form 1120s Schedule K 1 With Sample

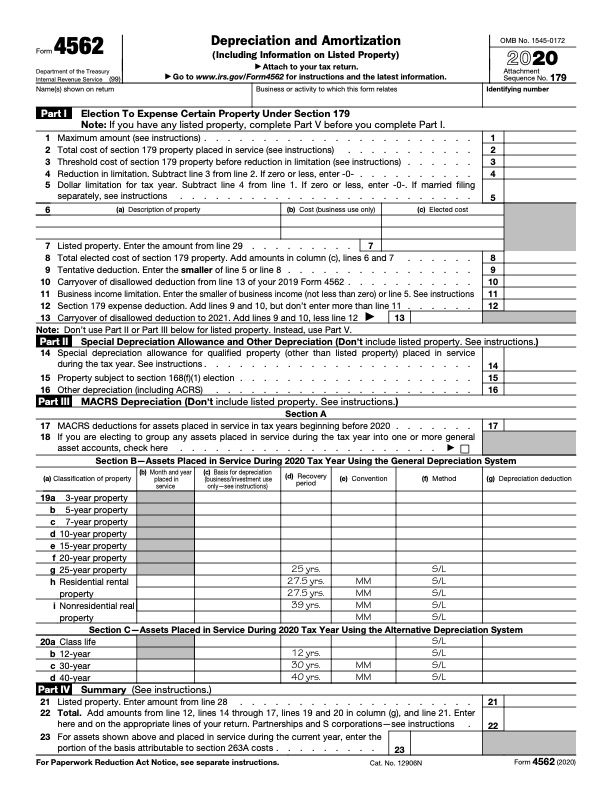

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

2014 2022 Form Mt Ui 5 Fill Online Printable Fillable Blank Pdffiller

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

:max_bytes(150000):strip_icc()/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Tax Filing 2021 Performance Underscores Need For Irs To Address Persistent Challenges U S Gao